Empowering MSMEs: Amartha Pioneers Credit Scoring for the Unbanked

By Team Amartha Blog - 1 Mar 2017 - 3 min membaca

Amartha Pioneers Credit Scoring for the Unbanked[/caption]

Amartha Pioneers Credit Scoring for the Unbanked[/caption]

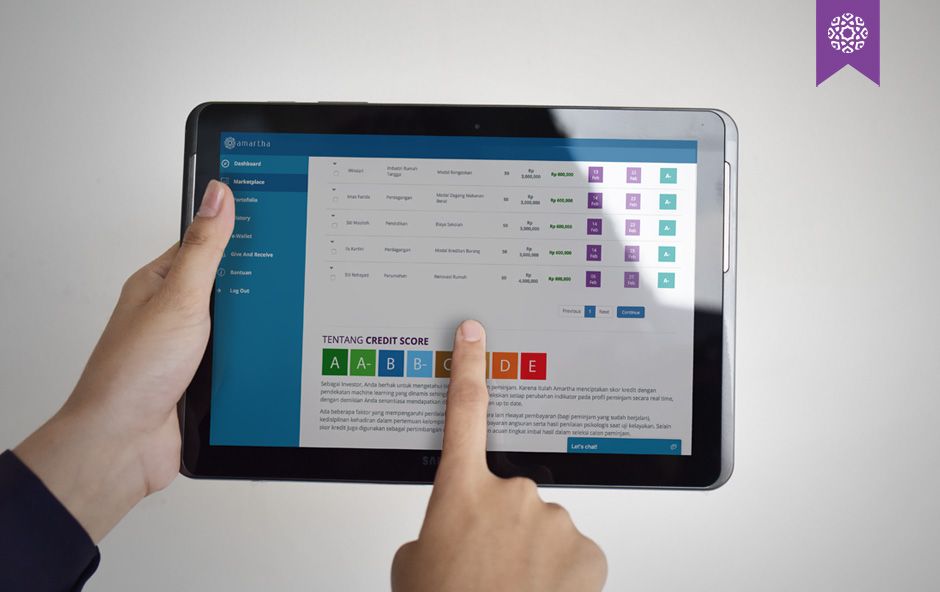

February 22, 2017. Amartha, a peer-to-peer (P2P) lending platform for micro, small and medium enterprises (MSMEs) launched the first credit scoring system designed specifically for unbanked communities in Indonesia. The system is expected to help MSMEs access loans more easily. Assigning borrowers credit scores will allow prospective investors to leverage this information and assess borrowers’ ability and willingness to pay.

Having transformed from a cooperative into a financial technology micro-lending company in 2016, Amartha believes the conventional credit scoring systems used by larger banks cannot accommodate the needs of MSMEs in Indonesia. Through the new credit platform, Amartha is optimistic about bridging MSMEs to investors.

With financial inclusion in mind, Amartha’s vision is to modernize technology for MSMEs and empower the informal economy.

"Currently, most risk assessment is done manually and collateral is a prerequisite for micro-borrowers. Banks also require adequate financial reports to see the performance of businesses. This scheme poses many challenges for MSME entrepreneurs with businesses in fish breeding, food vending and in other traditional markets", says CEO Amartha, Andi Taufan Garuda.

With nearly 30,000 borrowers, Amartha observed that the existing credit scoring methods such as BI Checking that serve businesses and individuals who already have a banking credit history are not compatible with its borrowing population. These systems don’t serve unbanked communities living in rural areas. As a solution, Amartha developed a system that uses psychometric analysis of a borrower’s personality and business profile to determine the credit score.

"We measure the correlation between unpaid credit and a borrower’s personality traits including the personality of borrower such as attitude, goodwill and borrower confidence,” explains Mr. Garuda Putra.

The results of the psychometric test can be applied to those who already have a

business or those who are just starting a business. The system is expected to enable the unbanked community to access affordable capital through Amartha’s online platform found at amartha.com.

Currently, most of Indonesia’s MSMEs don’t have access to banking services. Generally, they have lower levels of education and therefore work in the informal sectors of the economy and live in a state of financial limitedness. The Asian Development Bank reported in September 2015 that 78% of Indonesia’s 255 million are still considered unbanked. The number is far above the global average of 38%.

According to Vivi Alatas, the Lead Economist at the World Bank, “MSMEs contribute to 58% of Indonesia’s GDP, however, these numbers have remained stagnant since 2013.” The 57 million MSMEs in Indonesia employ 96% of the labor force.

Given the significant presence of MSMEs in the unbanked sector of Indonesia, there is high potential for these businesses to contribute to the national GDP and labor force if empowered financially.

Amartha’s Credit Scoring System

Amartha has pioneered credit scoring for the unbanked community in the following three ways:

- First, its dynamic system leverages big data and machine learning. As Amartha’s borrowing population increases, the system will continue to capture new borrower information in real-time and reflect accurate information pertaining to the borrower's ability and willingness to pay in installments.

- Second, Amartha can register applications, simulate credit limits, rates or loan tenures and originate loans much faster with the new technology. "We can present the table of loan simulations in real-time. Amartha’s engineering and data science teams are committed to continuously optimize the current system so that we can remove administrative-heavy processes such as the credit committee and disburse funds quickly," Mr. Garuda Putra explains.

- Third, Amartha conducted in-depth research to ensure its credit scoring system fits the character of the unbanked community and informal sector of Indonesia.

With this system, Amartha aspires to reach and serve more communities and bridge the unbanked, but credit-worthy borrowers to the real business sector. In the future, Amartha’s borrowers can use their credit scores and credit history given by Amartha when partnering with banking institutions to access formal funding.

With the credit scoring, Amartha strives to meet the principles of Pancasila "social justice for all the people of Indonesia," by providing the unbanked communities equal opportunities to prosper together.

About Amartha

Amartha (PT Micro Amartha Fintek) is a peer-to-peer (P2P) lending marketplace that makes it easier for investors to find investment opportunities within the micro, small and medium enterprises (MSME) in Indonesia. This innovative platform was developed from the original concept of group lending in 2010.

Investors can invest starting from Rp 3 million and manage their investment portfolio to independently determine which MSMEs they would like to support. Amartha’s transparent system provides investors information about the borrower’s personal profile, credit score and loan.

Investors can also reinvest their earnings (directly from their e-Wallet) or withdraw funds at any time. Since 2010, Amartha has served more than 60,000 members and has channeled more than Rp. 180 billion in financing to MSMEs in the rural areas of Indonesia while maintaining a default rate of 0%.

For more details, please contact:

Zakie Ahmad | Public Relations and Social Impact Strategist | ahmad.zaki@amartha.com

Artikel Terbaru

Artikel Sebelumnya

Artikel Selanjutnya

Artikel Terkait

Ada pertanyaan seputar artikel di blog Amartha? atau ingin mengirimkan artikel terbaik kamu untuk di publish di blog Amartha?

Hubungi Kami SEKARANG