Earn

Solutions for Amartha borrower to earn fixed income by converting balance into funding

Earn passive income by investing in selected MSMEs

Download App

Transfer saving balance to AmarthaEarn and receive the benefits

Get return up to 7% p.a*

Starting from 100,000 IDR and its multiplies

Accomplishing hajj savings, desired house and children's education funds

How to fund using AmarthaEarn

Registered as Amartha borrower and have an account on AmarthaFin app is a must

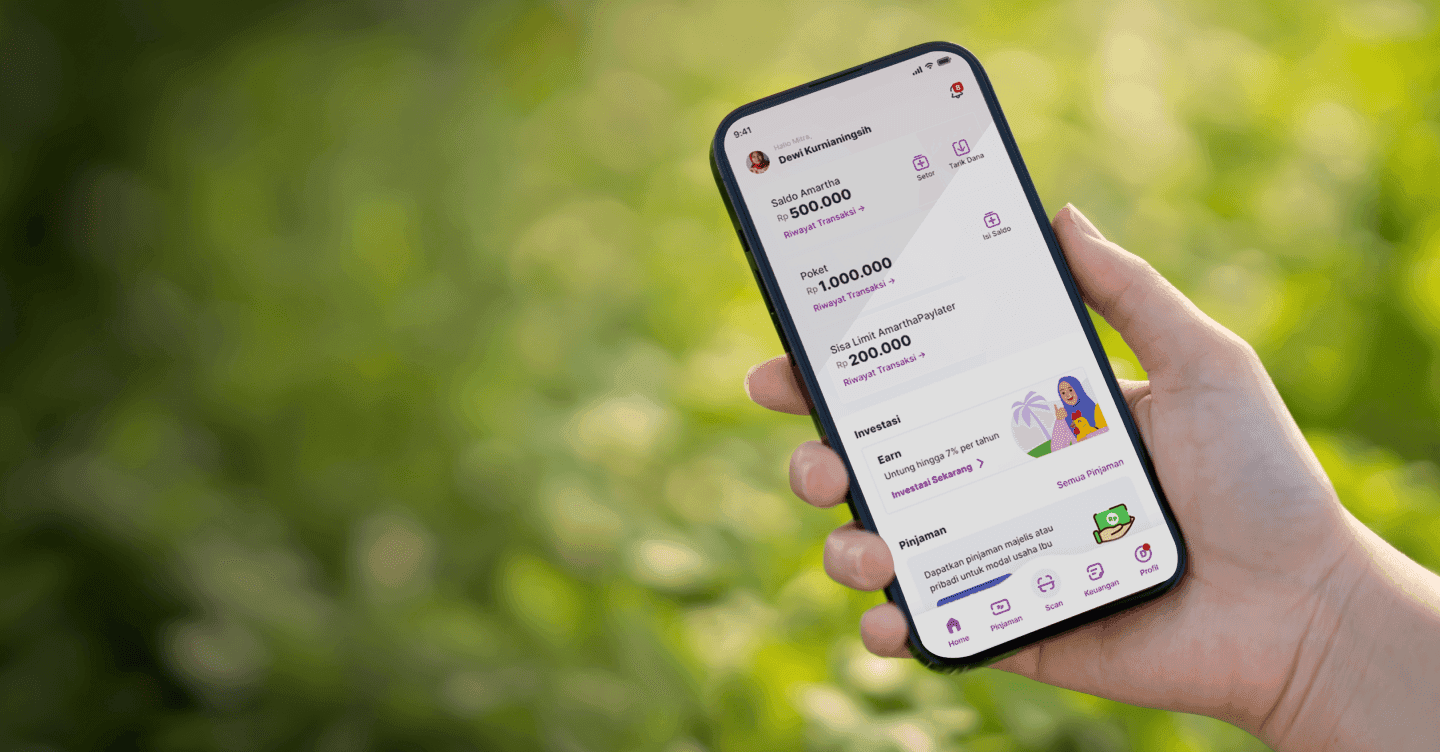

Open AmarthaFin app and make sure the available balance of min. 100,000 IDR

Find 'Pendanaan' menu and click 'Cari Tahu'

Choose or input the amount of balance to be transfered to AmarthaEarn, in the menu provided (multiples of 100,000 IDR)

Review the estimated profit listed on the page

If the balance in the AmarthaFin app is less than the desired amount, top up the balance at the nearest Amartha Officer or AmarthaOne Agent

Confirm the desired amount and click 'Lanjutkan'

Wait until there is a successful notification

Registered as Amartha borrower and have an account on AmarthaFin app is a must

Open AmarthaFin app and make sure the available balance of min. 100,000 IDR

Find 'Pendanaan' menu and click 'Cari Tahu'

Choose or input the amount of balance to be transfered to AmarthaEarn, in the menu provided (multiples of 100,000 IDR)

Review the estimated profit listed on the page

If the balance in the AmarthaFin app is less than the desired amount, top up the balance at the nearest Amartha Officer or AmarthaOne Agent

Confirm the desired amount and click 'Lanjutkan'

Wait until there is a successful notification

Get deeper understanding about fixed income at AmarthaEarn

With AmarthaEarn, receive annual return of up to 7%, valid during 12 months of lock-up period

Register Now

Popular Questions about AmarthaEarn

Are there any specific criterias to use the AmarthaEarn feature?

All Amartha borrowers with AmarthaFin account can use the AmarthaEarn feature.

How long is the funding period in AmarthaEarn

The Amartha Earn funding process will take place in real time. This means that if you already have a balance in the AmarthaFin app (minimum of 100,000 IDR), the funds will immediately proceed and be recorded in the system with a "Successful" notification that you will get after completing the funding.

Will the balance in AmarthaFin automatically converted to AmarthaEarn

AmarthaFin balance will not be self-directed to AmarthaEarn funding. For users and borrowers who already have a minimum balance of 100,000 IDR and multiples thereof, they can finance independently via the "Cari Tahu" button in the "Pendanaan" column in the AmarthaFin application.